Guarantor Mortgages are a way of securing a mortgage loan when you don't have a deposit or your credit history is putting lenders off. Someone agrees to act as guarantor for you, committing to make the repayments on your mortgage if you fail to do so. This is most commonly a parent or grandparent, which is why these products are often referred to as family-assisted mortgages.

A guarantor owns no share in the property purchased, nor are they named on the deeds. They simply sign a legal document stating that they agree to cover the mortgage repayments if the borrower cannot pay themselves.

To act as a guarantor, lenders usually require that you meet the following criteria:

A guarantor must possess sufficient assets to offer as part of the legal guarantee to the lender. Acting as a guarantor on a mortgage may mean you have to sign over a charge on your own property, giving the lender the authority to repossess it if repayments are not met.

If a guarantor doesn't own a property or has enough put away, cash savings can be offered as a guarantee. The agreed funds are put into a savings account with the lender and are released once a specified portion of the mortgage has been paid off. Typically, a guarantor is released from the mortgage agreement once the loan-to-value (LTV) has been reduced to around 80%, although it will vary depending on the lender and the applicant's circumstances. During this time, the guarantor will not be able to access the funds. They will usually, however, be eligible to earn interest on them.

Missing a mortgage repayment is never ideal, but with guarantor mortgages, it's especially important that you're aware of the consequences.

Each lender will have their own policy, but there are several things that could happen:

If you continue to miss repayments, the lender may take further action:

If you still owe the lender money after the property has been repossessed, they may go on to take further action to recover what they are owed.

Be honest. It's important that the borrower and guarantor are open with each other and consider all possible outcomes before entering into a contract.

Set boundaries. If you're acting as a guarantor for someone, it's important to remember that the property will be the borrower's home. Relationships could be damaged if you try to impose rules or have a say in matters beyond the mortgage agreement.

Seek professional advice. Financial matters can be complicated and entering into a mortgage agreement is a big deal! Formal agreements remove any grey areas and could save you from running into difficult situations in the future.

Think a guarantor mortgage might be the right option for you? Key Mortgage Advice can guide you through the process for no fee! We have offices in Southport, Preston and Garstang, or we can assist you over the phone if you prefer. You can find all of our contact details here.

Whether you're a first-time buyer, moving home or looking to remortgage, sifting through the thousands of available mortgage deals can seem daunting. If you’re feeling overwhelmed, it might help to talk to a mortgage broker.

A mortgage broker (or mortgage advisor) will search the market for you. They're there help you to choose the best possible mortgage deal. While banks will only offer you a mortgage loan from their own range, an independent mortgage advisor will look at all available options from hundreds of lenders, ensuring you get the best rate according to your circumstances.

Yes; with thousands of mortgage deals on the market, it can be hard to work out which one is right for you. Therefore, it's a good idea to speak to a mortgage broker at the beginning of your search.

A good broker will be able to look at your financial situation and sort through the deals available to you. They'll be able to find the ones which best match your needs and also be able to tell you which of the deals you're most likely to be accepted for - this can be advantageous, as a rejection can mean that you have to wait a period of time before you can apply again, which can significantly hold things up.

Once you’ve found the mortgage loan that's right for you, a mortgage broker can also help you with the application process. They'll make sure you fill out the forms right the first time and let you know what paperwork you'll need to complete your application.

Some advisors will offer additional services for a fee, even negotiating the purchase price for you in some cases.

A good mortgage broker should also be able to offer advice on other products, such as home and life insurance.

There are three main types of mortgage broker:

Tied: Brokers offering mortgages from a single lender

Multi-tied: Brokers offering mortgages from a particular group of lenders

Whole-of-market: Brokers offering mortgages from the entire market

If a broker says they are "independent", they should be offering you a whole-of-market service.

It is usually better to go with a whole-of-market or independent mortgage advisor as they have access to the widest range of products, missing out on only the direct-only deals offered by some lenders.

As well as finding out whether they are whole-of-market or tied to certain lenders, you should also check your chosen mortgage broker is regulated by the Financial Conduct Authority (FCA). This will ensure you receive a certain standard of advice. It will also mean you're able to complain to the Financial Ombudsman should anything go wrong.

Finally, make sure you ask how your broker will be paid.

All mortgage brokers will need to give you a document called a Key Facts Illustration (KFI) about their services. This document will detail how your broker will get paid, usually one of two ways:

Fees: Some brokers charge a fee for their services. They can charge a flat fee or an hourly rate, which will be agreed beforehand.

Commission: Others provide their services free of charge and receive a commission from the lender.

It’s best to ask up front how much you’ll be charged or whether the broker will receive a commission, so you can plan your finances accordingly.

Still unsure? Get in touch or drop into our offices in Preston, Garstang or Southport for more information on what an independent mortgage broker could do for you!

Back in September 2018, the government launched its Help to Save scheme. The scheme offers low-income earners the opportunity to boost their savings by 50%.

However, uptake of this cash-boosting incentive has been slow, with only 81,000 of the eligible 3.5 million people taking advantage of the scheme. John Glen MP, economic secretary to the Treasury, revealed the unimpressive figure in response to a parliamentary question on January 10th 2019.

So, who is eligible for the scheme and how does it work?

Those receiving working tax credit or universal credit are eligible to open a Help to Save account. If you and your partner are both in receipt of either of these benefits, you can both open an individual account. If you both take advantage of the scheme, you're effectively doubling the available savings boost.

The scheme will only affect your benefits if you or your partner already have savings in excess of £6,000. However, for those in receipt of working tax credit, having over £6,000 in savings won't affect your eligibility.

Compared to the savings accounts offered by banks (which tend to have an interest rate below 1%), the 50% bonus offered through the Help to Save scheme is extremely generous.

Once you've opened your Help to Save account, you can use it for four years. You can put away up to £50 a month and the government will top it up by 50%. The bonus is added on the two-year anniversary of the account being opened and again at the four-year mark. If you were to save the maximum amount each month for four years, you'd put away £2,400 and receive a respectable £1,200 bonus - meaning you'd end up with £3,600 in total.

Even if you're not able to put away the maximum amount each month, it's worth saving what you can. If you saved just half the maximum each month (£25), you'd receive a £600 bonus and have £1,800 in savings after four years.

The Help to Save scheme is intended to allow those on lower incomes to build an emergency fund. Having some money to assist in an emergency provides security and is much more cost effective than lending from a payday loan company.

If you want to take advantage of the Help to Save scheme, you can check your eligibility and set up an account on the government website.

Want to save for a mortgage? There are several other government initiatives you may be eligible to take advantage of. Have a look at our guide on Help Available to First Time Buyers.

With Brexit seemingly just around the corner and the possibility of further increases to the base rate, 2019 looks set to be a volatile year for the mortgage market.

While this could be a cause for concern in the long run, current uncertainty means that competition between mortgage lenders is fierce and opportunities for you to grab a great deal are plenty. So, whether you're a first-time buyer or a buy-to-let landlord, being proactive in the early part of the year could end up saving you thousands. Here's a rundown of the trends we expect to see emerge in the mortgage market over the course of 2019:

The number of first-time buyers being accepted for mortgages with low deposits is increasing, signalling that now could be a good time to land a great deal if you're looking to get on the property ladder. This price drop for 95% mortgages is in contrast to the current trend at lower loan-to-value (LTV) levels, where rates have been rising. The battle for new mortgage customers should continue, meaning even more competitive rates could potentially become available. Here are some other possible changes which would also benefit first-time buyers:

Young people are finding it increasingly difficult to save a deposit and, in response, the Building Societies Association has been trying to convince its members to be more lenient when it comes to first-time buyers. Since the financial crisis in 2008, 100% mortgages have disappeared. Whilst bringing them back would be a controversial move, there's a good chance of these deals coming back to the market in 2019. If they do, they'll probably be reserved for people in certain professions or those with a very strong credit record and proof of significant income.

Professional mortgages started to make a comeback towards the end of 2018, and they should continue to grow in number over the next 12 months. Lenders usually cap their offers around 4.5 times the annual income of the applicant (combined income if it's a joint application), but professional mortgages allow those in certain professions (e.g. doctors and dentists) to borrow up to 6 times their salary. Lending at multiples of over 4.5 is considered to be a risk, however, the high levels of competition could see more lenders offering these types of deals in the future.

![]()

Second steppers can often have a harder time finding a mortgage for their next home than they did finding their first. Low wage growth and increasing house prices have created an affordability gap which can be hard to overcome. With uncertainty around Brexit becoming a major concern, many are resolving to stay put, which could mean that lenders are incentivised to offer low-cost remortgage deals in the near future.

If you're looking to remortgage, you're most likely looking for a deal with an LTV ratio around 60-80%. Historically, these LTV levels have offered great rates. However, they've been creeping up in price in recent months. With further increases to the base rate on the horizon, the chances of rates coming down are low. Longer-term fixes will offer the best value in this area of the mortgage market and cashback/fee-free incentives will grow in number as lenders look to woo remortgage customers.

Everybody knows by now that staying on your lender's standard variable rate (SVR) costs you thousands more than the best deals. If you're looking to remortgage, now represents an opportunity to do so at a great rate. Five-year fixed-rate mortgages are increasing in popularity and, as such, offers are becoming more competitive. With switching offering savings of up to £4,000 per year, many people are likely to opt for a deal of this kind in 2019.

Last year, lenders began offering remortgaging products to those with Help-to-Buy equity loans. Most of the deals on offer, however, require you to pay off your equity loan in full, with little available to those who can't afford to do that. More people are coming to the end of their fixed terms in 2019, and as such, we expect to see more lenders launching mortgages for those with Help-to-Buy loans.

Landlords have had a tough time over the last couple of years, but 2019 might just offer some relief. New affordability criteria introduced in Autumn 2017 have made it harder for some landlords to secure loans, with lenders increasing the minimum interest cover ratio (ICR) to 145% or more. This means that rental income has to be at least 145% of the proposed mortgage repayments before they'll approve a loan. Lenders are beginning to relax their ICRs, with deals now available at an ICR as low as 125%. This should encourage more lenders to follow suit, meaning the buy-to-let mortgage market could become a little more enticing to would-be landlords.

In October last year, five-year fixed-rate mortgages for landlords hit an all-time low of an average 3.4%. Lenders also began to offer ten-year fixes on buy-to-let mortgages, another proposition which could increase in popularity throughout 2019. As with remortgages, fee-free deals are growing in availability, as lenders seek to tempt landlords who are looking to refinance their portfolios. Cashback offerings on buy-to-let mortgages also look set to increase over the coming year.

The easiest way to find a great mortgage deal is to speak to a broker with access to the whole of the mortgage market. Whether you're buying your first home or looking to grow your property portfolio, Key Mortgage Advice can help you find a mortgage perfectly suited to your circumstances, usually at no extra cost! Visit the Contact Us page and fill in our simple form to get a free callback!

Recent research suggests that it can now take up to 18 years for a person to save up for a deposit on their first home – no wonder so many young people turn to the bank of mum and dad to help them get on the property ladder! But the government is trying to help, with several schemes in place to assist with saving for a deposit. Also, there are many mortgage options available to first-time buyers which can make the process of buying a home seem a lot less daunting:

In December 2015, the government introduced the Help-to-Buy ISA. This is a savings account designed to help first-time buyers to save for a deposit. The scheme allows you to save up to £200 per month, although you can kick-start your savings with a lump sum of up to £1,200.

When you withdraw your savings to purchase your first property, you receive a 25% boost to your savings from the government, receiving up to £3,000 (on a £12,000 balance). There is a maximum property purchase price of £250,000 (or £450,000 if you’re buying in London).

Recent figures show that the Help-to-Buy ISA helped in almost 170,000 property purchases between December 2015 and June 2018.

However, from November 2019 the scheme is set to change with the introduction of the Lifetime ISA and changes to the maximum property purchase price. You can find details of the upcoming changes in our “How is Help-to-Buy Changing?” article.

Under the Help-to-Buy loan scheme, the government lends you up to 20% of the cost of a newly built property (40% if you’re buying in London) – so you can get a 75% LTV mortgage with only a 5% deposit. Even better, you’re charged no interest on the loan for the first five years.

According to the latest report, the government has provided £9.9bn in Help-to-Buy equity loans since the scheme began in April 2013. Almost 184,000 properties have been bought with these loans in England, with first-time buyers accounting for 81% of those purchases.

In the year to 30 June 2018, the number of first-time buyers purchasing properties under the Help-to-Buy loan scheme increased by 16% compared with the previous year, showing a major increase in its popularity with young people.

![]()

The shared-ownership scheme allows you to purchase between 25% and 75% of a property and pay rent on the rest of it. Homes being offered under this scheme are usually new-builds or those being resold by housing associations. Over time, you can purchase more of the property, increasing your share until you own 100% of it.

In England, you’re required to be a first-time buyer or someone who used to own but can't afford to now. Your annual household income has to be below £80,000, (£90,000 if you’re in London).

It is estimated that 200,000 UK households live in shared-ownership properties.

In 2017’s budget, it was announced that stamp duty (the tax applied when people buy a property above a certain value) would be scrapped for first-time buyers. This was extended to include shared-ownership properties last year (2018). HMRC estimates that more than 180,500 buyers have received the tax relief so far.

The shared-ownership scheme does have some risks. Mainly the fact that until you own 100% of the property, you’re seen as a tenant in law. This means that you could lose your property if you fail to keep up with rental payments. You’re usually also required to pay a maintenance or service charge on the entire value of the property, which could potentially be quite expensive.

Back in 2014, the government announced the starter-homes initiative. The plan is to build new homes and offer a 20% discount to first-time buyers between the ages of 23 and 40.

Construction on these starter homes is yet to begin, but when it does, they’ll mostly be on brownfield sites – land previously used for commercial or industrial purposes.

To be eligible for the discount, you’ll need a household income of under £80,000 (£90,000 if you’re buying in London).

On the starter-home initiative, housing minister Kit Malthouse has said: "Starter homes are part of this mission to build more, better, faster but it's important we get them right. We are working with the industry on the next steps as we move forward with development."

In addition to these government schemes, there are several mortgage options which can make it easier for you when buying your first property. From multiple-proprietor mortgages to gifted deposits, you can find out about all of the available options in our “Mortgage Options for First-Time Buyers” article.

If you’d like to discuss your options for getting a mortgage, you can speak to one of our friendly expert advisors, who will be happy to help you find the most affordable solution, usually at no extra cost. Visit our “Contact Us” page for details on how you can get in touch.

Trying to get a mortgage can be a daunting proposition, however, it’s not that difficult and there are several things you can do to improve your odds of being accepted. To have the best chance of securing the cheapest deals, you’ll need to have your finances in order before you apply.

Lenders all have their own set of criteria and what makes you attractive to one may not satisfy them all. Generally, they look at the following:

If you’re not registered to vote, you’ll find it very difficult to get a mortgage, even if you meet all the criteria. Lenders use electoral roll data to run identity checks: to check you are who you say you are, that the address you give them is legitimate and that you’re not laundering money.

Check with your local council if you’re unsure. If you’re not registered, get yourself on the electoral roll as soon as possible.

Lenders check your credit report to ensure that you’re financially responsible. They need to know that you're able to pay back what you borrow. Your credit report shows any overdrafts, credit cards, loans, and mortgages you’ve had in the last six years. It may also include any mobile phone contracts you’ve had and some utility accounts. You can access your credit report for free via Experian, Equifax, or CallCredit.

If there are any errors in your report, talk to the lender(s) associated with the erroneous data and they should be able to amend it for you. If that doesn’t work, contact the free Financial Ombudsman and they will step in to order the necessary changes.

If you’re always in your overdraft, lenders may see this as a sign that you’re not financially responsible. Some lenders may not accept you if you’ve been in your overdraft at any time within the last three months, so it’s best not to dip into it at all, if possible.

As for your credit cards, lenders prefer you to be using less than 50% of your available limit. Yet, they may also penalise you for having too much available credit, as there’s a chance you could suddenly spend it and rack up debt. Try to strike a balance; if you have £5,000 available credit, stay below the £2,500 mark. If you have £10,000 available credit and aren’t using any, consider reducing it a little to reduce the perceived risk to potential mortgage lenders.

Each time you apply for a new line of credit, the provider searches your credit file and this search is registered on your report. Having lots of searches on your file may look like you’re desperately trying to borrow money, and this will turn lenders off. If you must apply for credit, you’ll probably get away with one application, as long as it’s affordable. Don’t use payday loan companies, as some lenders will decline your mortgage application if you’ve used such a company within the last year.

If you have old, inactive credit accounts, these can be seen as a fraud risk. It’s worth closing any account you haven’t used within the past twelve months.

Long-term, stable credit relationships are seen in a positive light by lenders. So, if you’ve had a credit card for a while but recently stopped using it after getting a new one, it’s probably best to keep the account open until after you’ve applied to get a mortgage, as it could be giving your credit score a boost.

This might sound obvious, but did you know that missing just one payment will count against you for at least a year and will be visible on your credit report for the next six?! This could make it extremely difficult for you to get a mortgage.

Set up direct debits for all your accounts to make sure they’re always paid on time. If you’re struggling to keep up with payments, contact the lender before the next instalment is due and often they’ll be able to help and save you from defaulting.

Lenders need to see proof of your income before they can offer you a deal. They may want to see all or any of the following:

Lenders often want original bank statements (not copies printed out at home) so go into your local branch and ask for originals. These can take a couple of weeks to arrive, so it’s best to do this in advance.

It makes sense to have all these things ready to go, as it will save you time and reduce the number of people your application is reviewed by.

Make sure your application form is filled out honestly and accurately. Declare all your debts and give your exact income (don’t round up), as dishonest answers will mean a rapid decline of your application.

For example, if you have £20,000 to put down on a property worth £100,000 (making your loan-to-value 80%), it may be worth coughing up an extra £100 as it will make you more attractive to potential lenders. All mortgages have a maximum loan-to-value. Borrowing just below this will boost your chances of being accepted and may give you access to better rates.

If you get rejected, don’t apply for another mortgage straight away. As with applying for credit, more searches on your credit file will reduce your chances next time and you could end up making the problem worse. It’s best to contact the lender and find out their reasons for rejecting you. They may have their own reasons, but if it was your credit file, go through this guide again and tidy it up before trying to get a mortgage again.

Key Mortgage Advice are an independent mortgage broker with over 17 years’ experience in the market. We can help you through every step of your application and give you the best possible chance of being accepted for a loan. Contact us via the button below to arrange a free consultation. We’ll assist you in getting the key to your dream home:

First-time buyers are enjoying a period of increased mortgage application acceptance and low interest rates at present. However, looking forward, market conditions suggest that this could come to an abrupt end in the near future. For this reason, we feel that now represents the best opportunity for people to get their foot on the property ladder.

We’ve laid out the important factors below, to give you insight as to why you should consider getting your mortgage application in as soon as possible, to avoid being left disappointed:

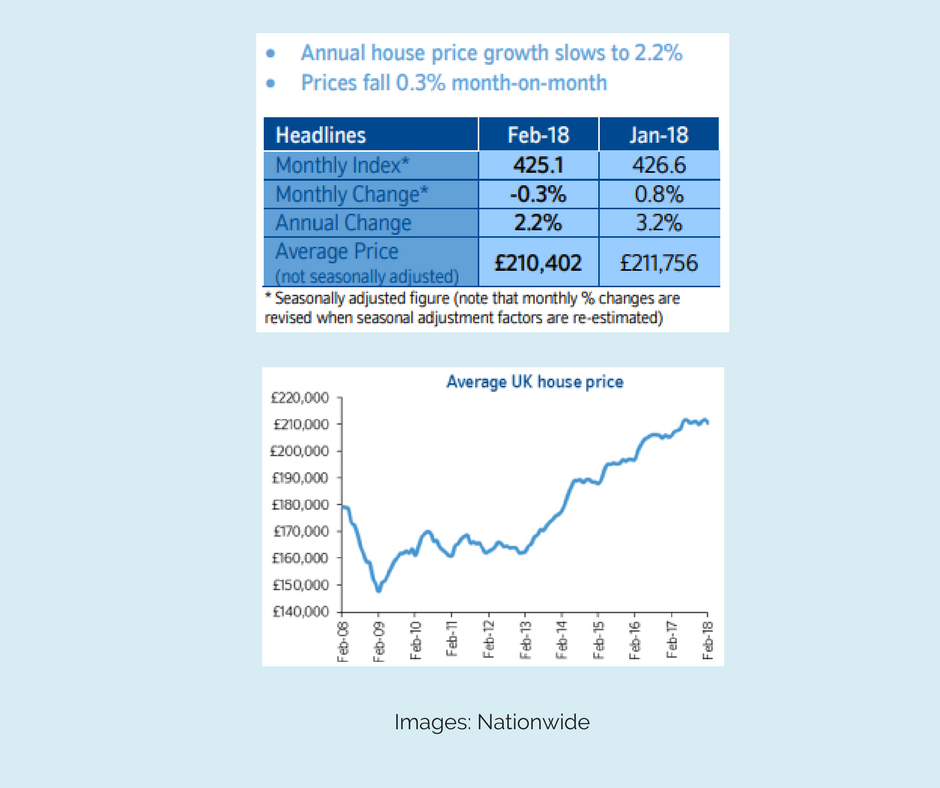

The average price of property has been increasing steadily year-on-year, with prices up 2.2% from this time in 2017. However, the month-on-month statistics show a change of -0.3% from January to February, according to Nationwide. With property prices expected to continue rising, this stall in growth represents a great opportunity to enter the market and get a good deal on a property:

First-time buyers are enjoying a period of high mortgage approval rates at the moment, with 74% of applications through a broker being approved in Q4 2017. That’s an incredible 21% increase from the same period the year before!

Data from the Intermediary Mortgage Lender Association (IMLA) suggests that this is due to a number of factors including low interest rates, improved product availability, and competition between mortgage lenders. This has improved access to mortgage finance overall, boosting the hopes of first-time buyers.

Whilst this is excellent news, it’s unlikely that this trend will continue for too much longer, meaning that potential buyers should be quick if they want to capitalise on the increased likelihood of their mortgage application being accepted.

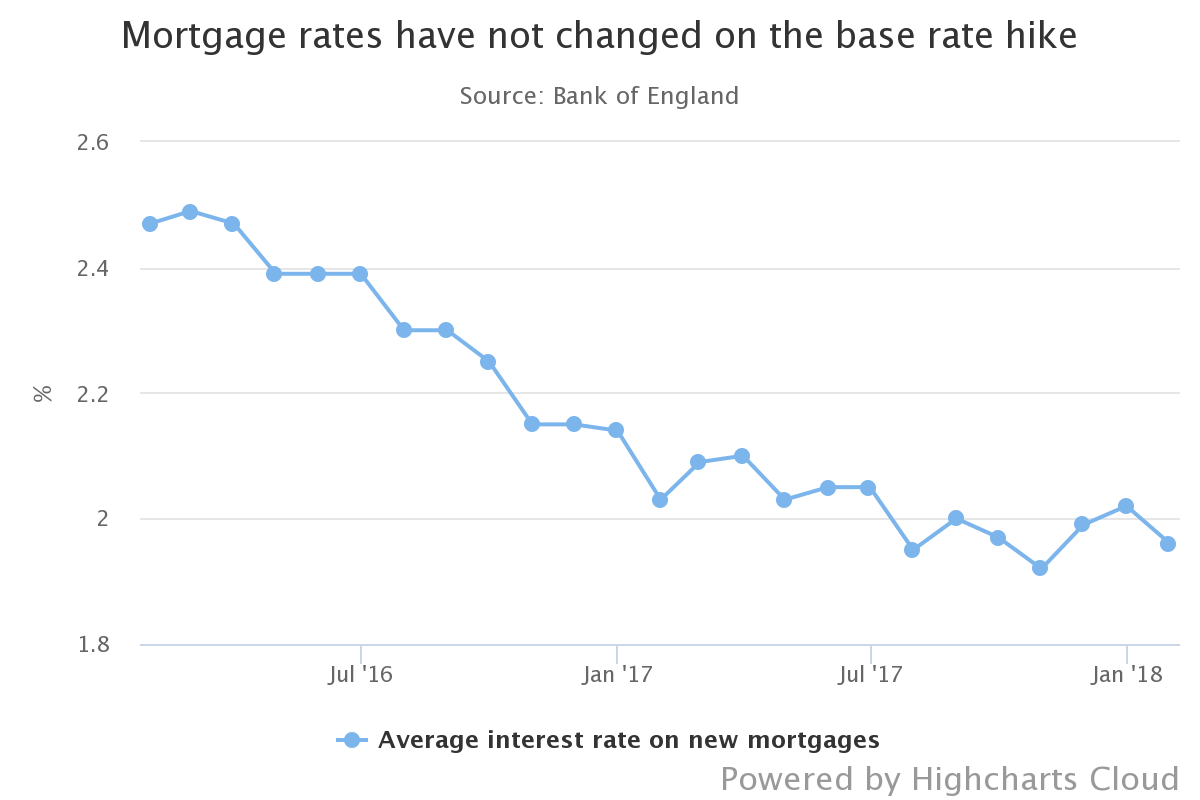

The reason that mortgage acceptance rates are likely to stall in the coming months is that the Bank of England have hinted at a possible interest rate increase in May. They also suggest that interest rates are to continue to rise in the future.

The base rate was raised in November last year, from 0.25% to 0.5%, paving the way for further increases in 2018. As interest rates rise, first-time buyers will find their mortgage applications increasingly scrutinised, possibly leading to a decrease in rates of acceptance. Analysts expect the base rate to be at least 1% come the end of 2018, so now represents the best time to apply.

Despite the expected base rate increase, interest rates on mortgages currently remain low, with lenders undercutting each other in what remains a highly-competitive market. Due to this, the base-rate hike in November had less of an impact on mortgage rates than expected:

However, further increases would likely see the best deals removed from the market and replaced with costlier alternatives, again suggesting that now is the perfect time to get your foot on the ladder.

If you’re considering purchasing a property, we can help you to find the best deal and give you the greatest possible chance of having your mortgage application accepted. Visit our “Contact Us” page for information on how you can get in touch.

It’s no secret that in today’s climate, more and more young people are turning to the bank of mum and dad when looking to get their foot on the property ladder. House prices have increased steadily over the last few years, with the average UK property costing a whopping £226,071 as of November 2017 – an increase of 5.1% over the previous year. [1]

With interest rates looking set to increase in the near future, first-time buyers face the prospect of further difficulties when applying for a mortgage. However, all is not lost. There are several options available to new buyers which may allow you to purchase a property with only a small deposit, or even without a deposit at all:

Multiple proprietor mortgages allow up to four people to purchase a property together. All are responsible for the loan and all own a stake in the property. This is a great option if you have a group of friends who are all looking to purchase a property and don't mind sharing a space. Mortgages for multiple proprietors take into account the income of all applicants, meaning that you’re much more likely to be accepted for a loan.

There are different ownership options depending on your relationship to the people you’re buying with, most common are joint tenants (everyone owns an equal share of the property) or tenants in common (each own a different share of the property). The best option for you will be dependant on your personal circumstances.

This type of mortgage allows an applicant to receive support from a friend or relative, without the other party owning a stake in the property. This usually requires a deed of trust to be written up, outlining what will happen should you fall behind with payments and who is liable if the deed of trust is broken. A will is also required for both parties, to establish what will happen to the property if either person should pass away.

The deed of trust should include a clause whereby the non-legal owner can give notice of their intention to leave the agreement, allowing them to move on should they wish. In this case, the legal owner would be required to remortgage or agree to sell the property.

Guarantor mortgages allow a relative or friend to guarantee the mortgage debt. This will often increase the amount a person is able to borrow. In most cases, the guarantor offers their property as collateral, meaning that they could lose their home if the legal owner of the new property were to fall behind with payments and they were unable to cover the cost themselves. However, if no repayments are missed, the guarantor incurs no fees.

This option enables a third party to gift the buyer a deposit. Essentially, a person (often a parent) pays the deposit on behalf of the buyer and signs a deed of gift, meaning that despite partly financing the purchase, they own no stake in the property. There is also the option of a deed of trust, whereby the third party may recoup the money gifted upon the sale of the property.

It is possible to purchase a property from a relative at lower-than-market value and use the equity as a deposit. This is also known as a concessionary purchase or gifted equity. This option is becoming increasingly popular as house prices have risen to the point where it is often possible for parents to use gifted equity to enable their child to purchase the property whilst still making a profit. This, of course, will depend upon personal circumstances.

As with purchasing a property from a relative, it is also possible for tenants to buy their home from the landlord, using gifted equity as the deposit, should the landlord be willing to sell the property for lower-than-market value. For example, if the property is worth £100,000, the landlord can choose to sell to the tenant for £90,000 and the £10,000 equity may be used as a deposit.

Shared ownership allows you to purchase a percentage of a property (usually 25-75%), with the remainder being owned by a housing authority or private developer. This typically means that a smaller loan is required and hence a smaller deposit. You will, however, be required to pay rent on the portion of the property you do not own.

If down the line, you want to increase your share in the property, the cost of the additional share will be priced depending on the value of the property at the time. This means that you will pay more for the additional share if your property’s value has increased since you bought the first share, and less if the value has decreased. It’s also worth bearing in mind that shared ownership properties are always leasehold.

The government has several “help to buy” schemes in place, including a shared ownership scheme (which works as outlined above), an equity loan, and a help to buy ISA. Details on how each of these schemes work can be found on the Help to Buy website.

If you’re considering using one of these methods to purchase your first property, or would like to discuss your options, don’t hesitate to contact us. We’d be delighted to offer you a free consultation, where we can discuss your individual circumstances and provide you with a range of options tailored to your specific needs. Our contact details can be found on the Contact Us page.

When it comes to buying a first home, an increasing number of people are opting for a new build. This is largely due to government incentives such as the help-to-buy scheme as well as the perceived ease of purchase.

As with everything, buying a newly-built property also has its downsides. There have been several high-profile horror stories in the news and this has caused some concern for first-time buyers. To help you decide whether a new build is right for you, we’ve had a closer look at the pros and cons:

Government Incentives – The UK’s help-to-buy scheme was introduced in 2013, and has helped thousands of first-time buyers get a foot on the property ladder. There are two options in the form of a mortgage guarantee and an equity loan, both available on new-build homes. The scheme does have its problems and, as with any investment, involves an element of risk. It is recommended that you speak with an independent advisor before committing to the scheme.

You can find a breakdown of the different help-to-buy options in this handy explanation via Money Supermarket.

Guarantees – Newly-built properties come with a 10-year structural warranty, protecting the buyer from any defects in the property’s structural integrity. This means that for the first decade (if you stay in your new home) you will have peace of mind in knowing that any structural issues will be covered.

Minimal Running Costs – Generally speaking, a brand new home will be more energy efficient than an older one. This will mean that your energy bills should stay relatively low, provided you’re conscientious when it comes to power consumption.

You are also less likely to encounter any repair costs, as fixtures and fittings should be in perfect condition when you move in. As long as you care for the property, maintenance and running costs should remain low for several years.

Ease of Purchase – Since you are purchasing a new home with no current tenant, the process tends to be a lot faster to complete once the property has been built. Since there’s no chain, you can be in your new home in as little as 6 weeks! Of course, this is no guarantee and you may experience delays.

Personalisation – In some cases, purchasers are able to choose the fixtures and fittings that will finish their new home. This gives you a fantastic opportunity for personalisation and some people see this as a huge benefit, especially if they plan to remain in the property for a long time.

Buying from a Plan – Often when purchasing a new build, you are buying a proposed property, not a bricks-and-mortar home. It can be difficult to visualise what the finished product will look like and the show home will rarely be an exact copy of the property you are buying. This can occasionally lead to feelings of disappointment if it doesn’t meet initial expectations.

Delays – Inevitably, most new-build projects experience delays. This can cause a problem depending on the length of validity on your mortgage offer. If the build is not complete by the time your offer expires, you will have to apply again.

Sizing – New builds are generally smaller than older homes; this is something to consider before committing to purchasing. Whilst your belongings may fit into a small space in theory, in practice it can be a whole different story!

You might also want to think about whether you have any plans to expand your family in the near future. A small home may be cosy for a couple, but add another little person into the mix and you could be struggling for space.

Living Conditions – Buying a property on a new development comes with another (rather noisy) price – you could find yourself living on a building site. It’s rare that all houses in a development are completed at the same time, so if yours is one of the first, you might be moving in whilst construction continues over the road.

After-Sales Service – If something does go wrong with your new property, you’ll likely want it repaired fast. Unfortunately, not all contractors are quick to respond to repair requests, despite having an obligation under warranty. This will largely depend on the contractor you choose, so it is definitely worth researching a company’s customer service record before buying from them.

If you’re interested in purchasing a new-build property or would like to discuss the pros and cons in more detail, Key Mortgage Advice are here to help. One of our independent experts would be happy to provide you with more information and assist you on your journey to purchasing a new home.

You can contact us via phone, email, or pop into our offices in Preston and Garstang. All contact information can be found here.