On Thursday, following a meeting of the Monetary Policy Committee, the Bank of England increased the base rate from 0.5% to 0.75%. This is the highest the base rate has been since 2009 and the rise has prompted many homeowners to consider looking for a fixed-rate mortgage deal.

What is the base rate?

The base rate is the interest rate set by the Bank of England Monetary Policy Committee and is the official interest rate used by Banks and Building Societies to calculate the rates for their products, including mortgages, loans, and savings accounts. Often, when the base rate goes up, so does the interest you pay on loans and mortgages, meaning you pay more. The interest paid to those with savings also goes up, so the news could be good or bad, depending on your personal circumstances.

Will all mortgages be affected?

No, it will depend on the type of mortgage you have.

Fixed-rate mortgage holders won’t see any immediate change. Your interest rate will remain the same for the remainder of your agreed term, however, when that term comes to an end, you may find that the product you are moved to is now more expensive than you expected. Depending on the penalty fee for ending your contract early, it may still be worth switching to a longer-term deal to protect against any future increases.

Those on a tracker mortgage will see an increase of 0.25% as tracker mortgages (as you may expect) follow the base rate.

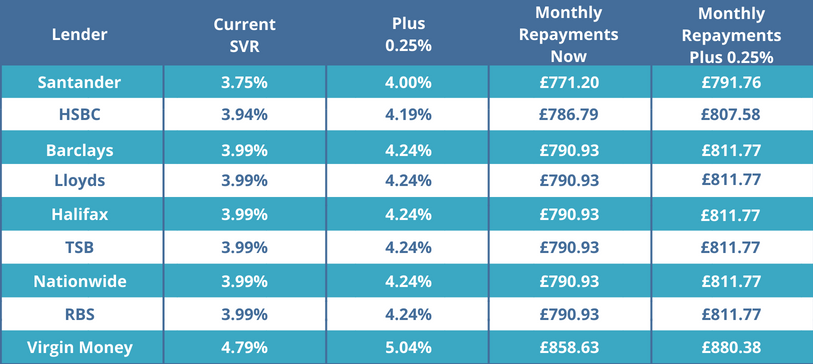

For people on a standard variable rate (SVR) mortgage, your rate is set by your lender and is likely to rise. Most lenders indicate that their SVR mortgages will see an increase of 0.25%, and this increase could happen as early as next month. This will depend on who your mortgage loan is with, as each lender will react differently – you should check with your mortgage provider to find out your rate will be affected. Below is a table showing the possible changes to monthly repayments, assuming lenders increase their SVR mortgage rates by the suggested 0.25%:

Is there still time to get a good fixed-rate deal?

Although the increase in the base rate will see a lot of the best recent deals withdrawn, there are still plenty of attractive mortgage products available. Rates have slowly been creeping up since the last rate hike in November last year, but many fixed-rate deals remain very competitive.

As an independent advisor, we have access to all the available deals at any given time. So, if you’re looking to buy your first property or remortgage your current one, it’s worth having a chat with us about your options. This way, you can be confident that you’re getting the best possible value. Use the button below to book a consultation with us at one of our offices in Preston, Southport, or Garstang: